About

The reinsurance module is the basic part of the software. Its aim is to allow the company to:

- Make and generate the obligatory reinsurance and facultative policies

- Take all the possible precautions to be covered : by the treaties or in facultative, and to take all the possible measures on risks which are involuntarily non covered

- Distribute automatically the paid claims, the recoveries and the reserves on outstanding claims according to the policy distribution

- Calculate automatically the treaty account and the reinsurer

- Produce the reinsurance bordereaux, claims paid, recoveries, outstanding premium, etc…

- Produce the recapitulation by reinsurance, by category etc…

- Generate automatically the reinsurance accounting entries

The reinsurance module manages all type of treaties: Quota share, Surplus, automatic facultative treaties, Excess of loss, etc… The policy distribution is done automatically according to the category, capital insured and the nature of its risk…

Managed Operations

The Reinsurance module manages all the required operations for:

- Reinsurers

- Treaties (All Types)

- Reinsurance Distribution

- Automatic Reinsurance Distribution

- Etc…

Reports & Inquiries

- Treaties List

- Distribution By Category

- Reinsurance Bordereau

- Claims Paid Bordereau

- Recoveries Bordereau

- Outstanding Claims Bordereau

- Facultative Placements Journal

- Facultative Placements / Reinsurer

- Facultative Placements (Due Dates)

- Reinsurance Accounts By Reinsurer

- Reinsurance Accounts

- Recapitulation By Reinsurer

- Recapitulation By Reinsurer By Category

- Treaty Placement Journal

- Loss Settled By Treaty

- Loss Recovered By Treaty

- Outstanding Claims Bord./Treaty

- Risk Profile (Fire)

- Risk Profile (Marine Cargo)

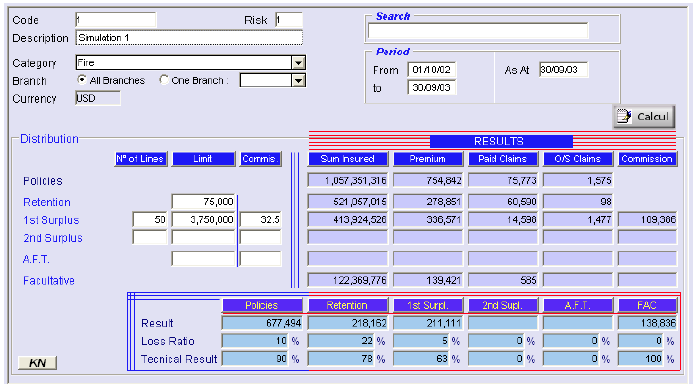

Reinsurance Simulation Program

Simulation program for reinsurance distribution:

- Cession Profile (Fire)

- Cession Profile (Marine Cargo)

- Cresta

- Earthquake

- Storm, Tempest, Flood

- Etc…

- Data entry of Branch, Risk, etc…

- Data entry of distribution limits (Retention, Surplus, AFT)

- Data entry of Period (From / To / As at)

- Computation of the distribution of the entire issued policies in the selected period

- Distribution of the claims paid in the selected period

- Distribution of the Outstanding claims as at the end of the selected period

- Printing of the reinsurance bordereau, the paid claims bordereau and the outstanding claims bordereau

- Printing of the distribution summary